In today’s diverse workforce, part-time workers play a crucial role in various industries. As employers strive to accommodate these employees, providing accurate and detailed paystubs becomes essential. Paystubs are not only a record of earnings but also a vital document that helps part-time workers understand their pay, taxes, and deductions. In this article, we’ll explore how to generate paystubs for part-time workers, the key elements to include, and the benefits of using a free paystub generator.

Understanding the Importance of Paystubs for Part-Time Workers

Paystubs are important documents for all employees, including part-time workers. They serve several key purposes:

- Transparency: Paystubs provide clear information about earnings and deductions, promoting transparency between employers and employees.

- Record-Keeping: Part-time workers often rely on paystubs for personal financial management. These documents are essential for tracking income, preparing tax returns, and applying for loans or credit.

- Tax Compliance: Paystubs detail tax withholdings, helping employees understand their tax obligations and ensuring compliance with federal and state laws.

- Benefit Awareness: Many part-time workers may be eligible for certain benefits, such as health insurance or retirement contributions. Paystubs help them understand their participation in these programs.

Key Elements to Include in Paystubs for Part-Time Workers

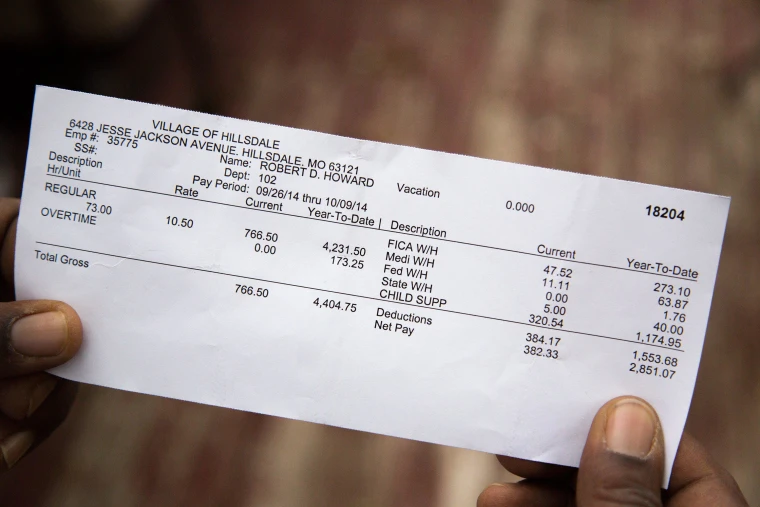

When generating paystubs for part-time workers, it’s important to include specific information that reflects their unique employment situation. Here are the essential elements to include:

1. Employee Information

Each paystub should clearly display the employee’s information, including:

- Full Name: Ensure that the name matches the employee’s official documentation.

- Employee ID: If applicable, include an employee identification number for record-keeping purposes.

- Address: The employee’s home address may be required for tax purposes.

2. Employer Information

It’s equally important to provide the employer’s information, including:

- Company Name: The official name of the business.

- Company Address: The physical address of the employer.

- Contact Information: A phone number or email address for any employee inquiries.

3. Pay Period Dates

Clearly indicate the pay period covered by the paystub. This typically includes:

- Start Date: The first day of the pay period.

- End Date: The last day of the pay period.

4. Hours Worked

For part-time workers, tracking hours is crucial. The paystub should include:

- Regular Hours: The total number of regular hours worked during the pay period.

- Overtime Hours: If applicable, include any overtime hours worked and the corresponding overtime rate.

5. Earnings Breakdown

The paystub should detail the employee’s earnings, including:

- Gross Pay: The total earnings before any deductions. For part-time workers, this is calculated by multiplying the hourly wage by the total hours worked.

- Net Pay: The amount the employee takes home after deductions. This figure should be clearly highlighted.

6. Deductions

Paystubs must list all deductions that have been taken from the employee’s gross pay. Common deductions for part-time workers include:

- Federal Income Tax: The amount withheld for federal taxes based on the employee’s tax bracket.

- State and Local Taxes: Depending on the jurisdiction, these may also need to be withheld.

- Social Security and Medicare: These mandatory deductions should be itemized.

- Health Insurance and Other Benefits: If applicable, include any deductions for health insurance or retirement contributions.

7. Year-to-Date Totals

Including year-to-date (YTD) totals helps both the employer and the employee keep track of earnings and deductions throughout the year. This should include:

- YTD Gross Pay: The total earnings for the year up to the current pay period.

- YTD Deductions: The total amount of deductions taken out for taxes and benefits.

8. Payment Method

Indicate how the employee is being paid—whether via direct deposit, check, or another method. This information is useful for record-keeping and clarity.

Steps to Generate Paystubs for Part-Time Workers

Creating paystubs for part-time workers involves several straightforward steps. Here’s how to do it:

Step 1: Gather Employee Information

Start by collecting the necessary information about the employee, including their name, address, employee ID, and hours worked during the pay period.

Step 2: Determine Pay Period and Hours Worked

Establish the pay period for which you are generating the paystub. Calculate the total hours worked, including regular and overtime hours, if applicable.

Step 3: Calculate Gross Pay

To calculate gross pay for part-time workers, multiply the employee’s hourly wage by the total hours worked during the pay period. For example:

Gross Pay=Hourly Rate×Total Hours Worked\text{Gross Pay} = \text{Hourly Rate} \times \text{Total Hours Worked}Gross Pay=Hourly Rate×Total Hours Worked

Step 4: Calculate Deductions

Determine the appropriate deductions for federal, state, and local taxes, as well as Social Security and Medicare. If the employee has opted into benefits, calculate those deductions as well.

Step 5: Calculate Net Pay

To find the net pay, subtract the total deductions from the gross pay:

Net Pay=Gross Pay−Total Deductions\text{Net Pay} = \text{Gross Pay} – \text{Total Deductions}Net Pay=Gross Pay−Total Deductions

Step 6: Create the Paystub

Using the gathered information and calculated figures, create a paystub. Ensure that all key elements are included and formatted clearly.

Step 7: Distribute the Paystub

Once the paystub is generated, distribute it to the employee. This can be done electronically via email or through a payroll system, or by providing a printed copy.

Using a Free Paystub Generator

Utilizing a free paystub generator can significantly simplify the process of generating paystubs for part-time workers. Here are some advantages of using such a tool:

1. Automated Calculations

Free paystub generators often automate the calculations for gross pay, deductions, and net pay. This minimizes the risk of human error and ensures accuracy.

2. Customizable Templates

Many paystub generators offer customizable templates that allow employers to include specific details relevant to their part-time workers, such as unique deductions or benefits.

3. Professional Appearance

Using a paystub generator ensures that paystubs are professionally formatted and easy to read. A well-organized paystub contributes to better employee understanding.

4. Instant Access

Free paystub generators allow employers to create and distribute paystubs quickly. Employees can receive their pay information without unnecessary delays, which promotes transparency.

5. Record Keeping

Some paystub generators enable employers to keep digital records of all paystubs issued. This is valuable for auditing purposes and for employees who may need to reference past pay information.

6. Educational Resources

Certain paystub generators provide educational resources or tips to help employees understand the information on their paystubs, which enhances financial literacy.

Conclusion

Generating accurate paystubs for part-time workers is an essential aspect of payroll management. By including all relevant information—such as earnings, deductions, and year-to-date totals—employers can promote transparency, trust, and financial awareness among part-time employees. Utilizing a free paystub generator streamlines the process, ensuring accuracy and professionalism in paystub creation.

In an increasingly complex financial landscape, accurate paystubs empower part-time workers to manage their finances effectively, understand their tax obligations, and make informed financial decisions. By prioritizing the generation of clear and accurate paystubs, employers can foster a positive work environment and support the financial well-being of their part-time workforce.

MORTON DAVIES Instant Jeans Button Pins Waist Tightener Set, Make The Waist Fit for Skirt Pants Robe, No Sewing Required Adjustable Waist Buckle for Loose Jeans Pants (4 pcs New White Flower pin)

₹199.00 (as of 22 November, 2024 18:32 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Milton Thermosteel Flip Lid Flask, 1000 milliliters, Silver

₹963.00 (as of 22 November, 2024 18:32 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Pigeon 1.5 litre Hot Kettle and Stainless Steel Water Bottle Combo used for boiling Water, Making Tea and Coffee, Instant Noodles, Soup with Auto Shut- off Feature

₹649.00 (as of 22 November, 2024 18:32 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Orient Electric Areva Portable Room Heater | 2000W | Two Heating Modes | Advanced Overheat Protection | Horizontal & Vertical Mount | 1-year replacement warranty by Orient | White

₹1,449.00 (as of 22 November, 2024 18:32 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)MOROVIK Portable Mini Sealing Machine, Handheld Packet Sealer for Food, Snacks, Chips, Fresh Storage, Plastic Bags Sealing Machine, 1 YEAR Warranty (MULTI)

₹279.00 (as of 22 November, 2024 18:32 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Discover more from The General Post

Subscribe to get the latest posts sent to your email.