The use of e-invoicing in Saudi Arabia is changing the business environment in Saudi Arabia. This is a significant development for small enterprises that want to update their financial procedures. In Saudi Arabia electronic invoicing signifies a substantial transition from conventional paper-based invoicing to a more efficient and precise digital system that improves transactional efficiency. Small firms can automate their invoicing procedures lower manual mistake rates and guarantee compliance with Kingdom regulatory standards by adopting e-invoicing. This change not only makes business financial administration easier, but it also supports the larger goals of efficiency and transparency in Saudi Arabia’s economy.

Small businesses must comprehend the advantages of e-invoicing and the best ways to use it as it becomes a crucial component of corporate operations. The goal of e-invoicing’s implementation in Saudi Arabia is to help companies reduce operating expenses and achieve better financial record accuracy. This blog will give small businesses useful advice and practical insights on how to successfully adopt e-invoicing in Saudia Arabia so they can take advantage of its benefits and manage this transition with ease.

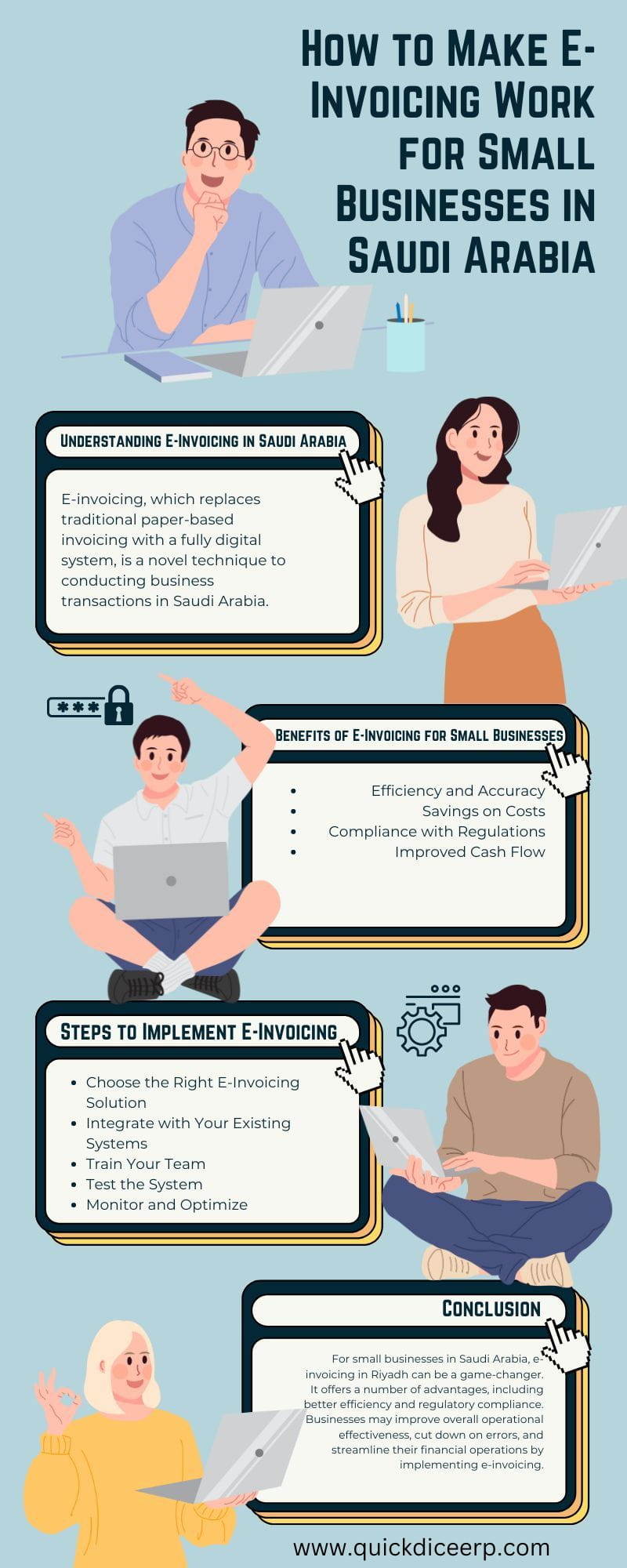

Understanding E-Invoicing in Saudi Arabia

E-invoicing, which replaces traditional paper-based invoicing with a fully digital system, is a novel technique to conducting business transactions in Saudi Arabia. The Zakat, Tax and Customs Authority ordered this change with the intention of improving financial transparency and expediting the invoicing procedure. The system guarantees that all financial records are prepared, delivered and preserved electronically by digitizing invoices, greatly lowering the possibility of errors and fraud. The transition to electronic invoicing is consistent with larger initiatives to modernize the economy and encourage productivity in the business sector.

The transition to electronic invoicing for small firms can seem daunting at first, but there are significant advantages if it’s incorporated into regular operations. The digital system helps to maintain regulatory compliance in addition to enabling quicker and more accurate invoicing processing. Comprehending the essential ideas behind electronic invoicing and its benefits will aid small enterprises in managing this shift with efficiency resulting in enhanced budgetary control and decreased administrative workload.

Benefits of E-Invoicing for Small Businesses

1. Efficiency and Accuracy:

By automating the invoicing process and doing away with the need for manual data entry, e-invoicing greatly improves operational efficiency. By lowering the possibility of human error, this technology guarantees correct and timely processing of bills. E-invoicing reduces the possibility of client disputes and helps keep accurate financial records by offering a simplified method of invoice administration. In addition to guaranteeing accurate billing, the improved precision promotes dependability and trust in commercial dealings.

2. Savings on Costs:

For small firms, switching to e-invoicing offers significant cost savings prospects. Businesses can significantly cut their overhead costs by doing away with fees for paper, printing, and postage. Additionally, by automating invoicing procedures, less manual interventions are required, which reduces administrative expenses. Businesses are able to reallocate resources more effectively thanks to this financial efficiency, which supports their overall operational and strategic goals.

3. Compliance with Regulations:

By guaranteeing that all invoices are precisely recorded and easily accessible for audits, electronic invoicing assists small enterprises in adhering to Saudi Arabia’s regulatory obligations. The system’s capacity to keep thorough electronic records streamlines the compliance procedure and lowers the possibility of fines for non-compliance. Businesses can more easily comply with the Kingdom’s tax laws and reporting requirements by incorporating e-invoicing, which encourages a seamless and legal financial operation.

4. Improved Cash Flow:

The fact that e-invoicing improves cash flow is one of its main benefits. Businesses can enhance their total cash flow and accelerate payment cycles by streamlining the invoicing process. The technology makes it easier to track invoices and send out timely reminders, which guarantees that payments are made on time. The smooth processing of invoices contributes to a consistent flow of money, which is essential for maintaining daily operations and fostering corporate expansion.

Steps to Implement E-Invoicing

1. Choose the Right E-Invoicing Solution:

It is essential to choose the correct e-invoicing solution to guarantee that the system satisfies your business requirements and conforms with regional laws. Choose a platform that can easily integrate with the ERP and accounting tools you already have in place. This will streamline operations and cut down on human data entry. Additionally, a user-friendly interface is essential since it will facilitate your team’s adoption process. Make sure the solution has strong security measures in place to guard against cyber-attacks and unauthorized access to critical financial data.

2. Integrate with Your Existing Systems:

simplifying the invoicing process requires integrating your selected e-invoicing solution with your present accounting and ERP systems. Automatic data transfer between systems reduces manual input and errors. Proper integration ensures accurate invoice data and a smooth workflow. It also helps maintain business continuity without disrupting current workflows.

3. Train Your Team:

Implementing an e-invoicing system properly requires effective training. Ensure all staff members receive thorough training on creating, submitting, and troubleshooting invoices with the new system. Training should cover all aspects of electronic invoicing, creating bills to troubleshooting issues. Proper training ensures a smooth transition.

4. Test the System:

Conduct a pilot test to identify issues before fully adopting electronic invoicing. Use the trial period to assess the system’s performance and fix problems. Testing minimizes issues during full implementation by confirming the system meets business needs and performs as expected.

5. Monitor and Optimize:

After launching the e-invoicing system, continuously monitor and optimize its effectiveness. Regularly evaluate system performance and gather staff feedback to identify areas for improvement. Use this information to make improvements and adjustments. Ensure the system remains effective and aligns with your company’s goals. Ongoing optimization ensures sustained success with your e-invoicing solution. It helps you adapt to changes in your business environment or regulatory requirements.

Conclusion:

For small businesses in Saudi Arabia, e-invoicing in Riyadh can be a game-changer. It offers a number of advantages, including better efficiency and regulatory compliance. Implementing e-invoicing boosts operational efficiency, reduces errors, and streamlines financial operations. This shift supports the Kingdom’s modernization goals, helping companies maintain accurate records and ensure timely payments. In Riyadh’s dynamic economy, small businesses can streamline transactions and enhance financial management by integrating e-invoicing.

Businesses in Riyadh can benefit greatly from adopting electronic invoicing. Staying competitive requires modern financial tools. Follow implementation steps and optimize systems for a smooth transition to e-invoicing. Small enterprises can thrive in Riyadh’s evolving market.

Honeywell Air Purifier for Home, 4 Stage Filtration, Covers 388 sq.ft, High Efficiency Pre-Filter, H13 HEPA Filter, Activated Carbon Filter, Removes 99.99% Pollutants & Micro Allergens - Air touch V2

₹7,999.00 (as of 20 November, 2024 18:31 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Zulaxy Photo Frame Hooks for Wall Without Drilling, 10 Pack Self Adhesive Hooks for Wall Heavy Duty Strong Nail Free for Hanging Photo Frame (Hanging Hook, Transparent) Stainless Steel

₹274.00 (as of 20 November, 2024 18:31 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)GIGAWATTS 10.5 MTR/38 LED String Light 360° Copper Power Pixel 35 Feet Serial Decorative Fairy Lights for Home Diwali Christmas Festival Wedding Party & Garden (Pack of 1, Warm White)

₹89.00 (as of 21 November, 2024 18:32 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Gas Lighter for Kitchen Use | Rechargeable Electric Lighter | Lighter | Stove & Candle Lighter with USB Charging Port | 1 Year Warranty | 600 Uses in Single Charge

₹298.00 (as of 21 November, 2024 18:32 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)SHAYONAM Cordless Portable Wireless Pressure Washer Gun 48V 12000mah High Pressure Water Gun for Car Wash Bike Washing Cleaning| Adjustable Nozzle and 5M Hose Pipe (Double_Battery) (Black)

₹1,699.00 (as of 21 November, 2024 18:32 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Discover more from The General Post

Subscribe to get the latest posts sent to your email.