Introduction to Bidencash

In today’s fast-paced financial landscape, maintaining a good credit score is crucial. Whether you’re applying for a loan, renting an apartment, or even securing insurance, your credit history plays a pivotal role in shaping those opportunities. Enter Bidencash.cc—a platform designed to help individuals boost their credit scores and take control of their financial futures. But does it really work? We’ve gathered real users’ experiences to uncover the impact Bidencash can have on your credit journey. Read on to explore how this innovative service functions and hear inspiring success stories that might just motivate you to give it a try!

How Does Bidencash Work?

Bidencash operates by leveraging users’ everyday spending to help improve their credit scores. When you sign up, the platform links with your financial accounts securely and monitors your transactions.

Each time you make a purchase, Bidencash calculates how much of that spending can be reported to credit bureaus. It’s not just about big expenses; even small, routine purchases can contribute positively.

The service focuses particularly on ensuring that timely payments are reflected in your credit history. By reporting these payments regularly, Bidencash helps to showcase responsible financial behavior.

Users receive insights and updates along the way. This keeps them informed about their progress without overwhelming them with complex jargon or processes. It’s designed to be user-friendly while still effective at boosting credit scores over time.

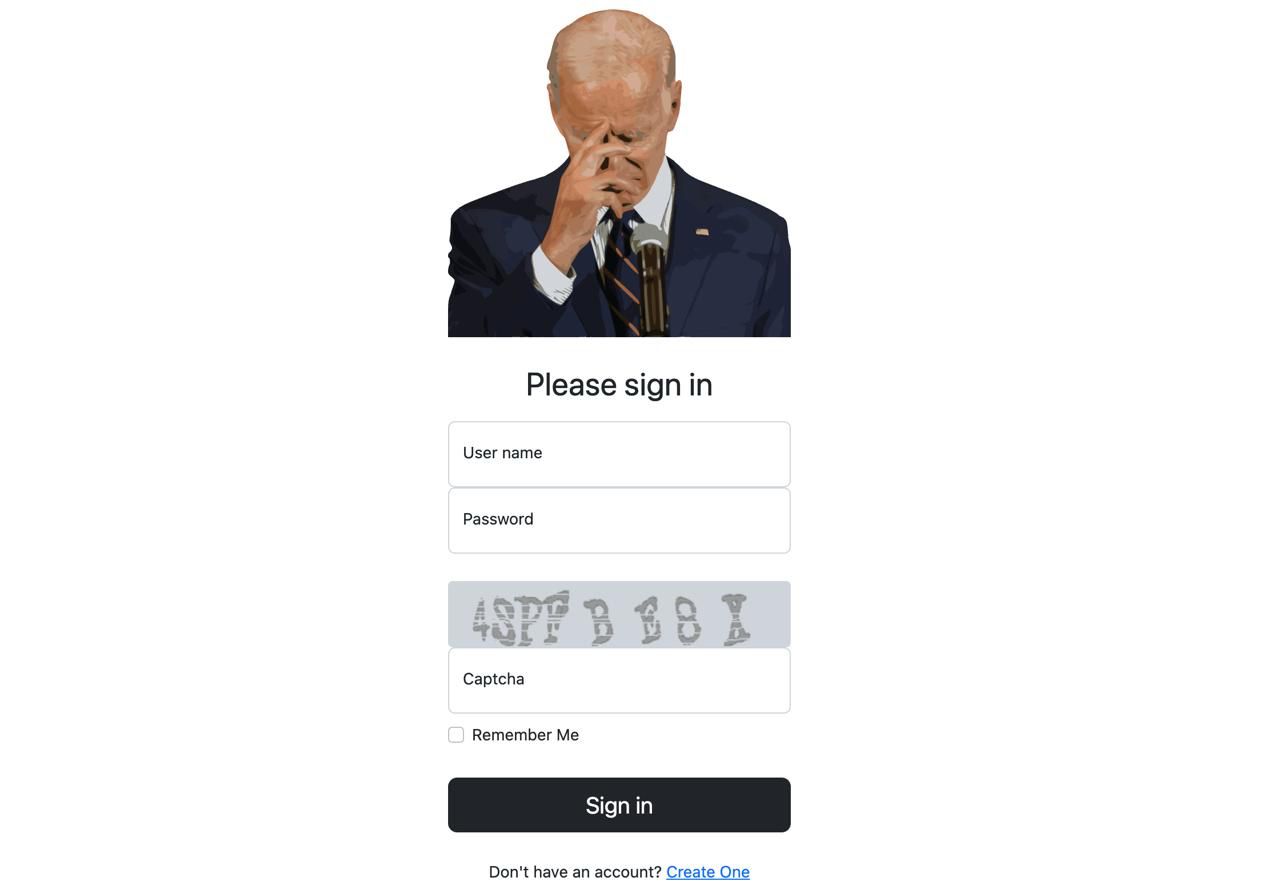

A Screenshot of Bidencash (bidenscash.cc) login page

Success Stories from Real Users

Many users have experienced remarkable transformations with Bidencash. One user, Sarah from Texas, shared how she boosted her credit score by 120 points in just three months. She was thrilled to qualify for a better mortgage rate.

Another success story comes from Mark in California. After using Bidencash.cc consistently for six months, he managed to raise his score significantly enough to finally buy his first car without high-interest rates. His excitement was palpable as he recounted the process.

Then there’s Lisa, who faced significant financial hurdles after unexpected medical bills impacted her creditworthiness. Through Bidencash’s guidance and tools, she not only improved her score but also regained confidence in managing her finances effectively.

These stories are inspiring examples of real people overcoming their credit challenges through determination and smart use of resources like Bidencash.

Related: Jokerstash

The Benefits of Using Bidencash

Bidencash offers a range of benefits that can significantly impact your financial health. One standout feature is its ability to quickly improve your credit score. Users often see noticeable changes within weeks, making it an appealing option for those in need of immediate assistance.

Another advantage is the user-friendly interface. Navigating through the platform is simple and efficient, which makes managing your credit journey less stressful. This ease of use encourages more individuals to take charge of their finances.

Additionally, Bidencash login provides access to valuable resources and tools designed to educate users about credit management. These insights empower you with knowledge, helping you make informed decisions moving forward.

Real-time monitoring alerts keep you updated on any fluctuations in your credit profile. Staying informed not only helps maintain progress but also builds confidence as you work towards achieving better financial stability.

Potential Risks and Limitations

While Bidencash offers various benefits, users should be aware of potential risks and limitations. Credit boosting services can sometimes lead to unexpected consequences. Changes in your credit profile may not always reflect the anticipated improvements.

Another concern is data privacy. When using any financial app, sharing personal information raises questions about security and how that data is handled. It’s crucial to ensure that the platform adheres to strict privacy standards.

Additionally, results are not guaranteed for every user. Factors like existing credit history and current debt levels can influence outcomes significantly. Not everyone experiences the same level of success with Bidencash.

Fees associated with certain premium features might deter budget-conscious individuals from fully utilizing their services. Weighing these factors against potential gains is essential before committing to any program aimed at improving your credit score.

Tips for Maximizing Your Credit Boost with Bidencash

To get the most out of Bidencash, start by setting clear goals for your credit boost journey. Knowing what you want to achieve helps tailor your approach.

Engage consistently with the platform’s features. Regular interaction can unlock additional resources and insights.

Keep an eye on your credit report as you utilize Bidencash cc. Understanding where you stand financially allows you to make informed decisions.

Consider integrating other financial tools alongside Bidencash. Combining strategies can provide a more holistic view of your credit health.

Don’t hesitate to ask questions in community forums or support channels provided by Bidencash. Real-time feedback from users and experts is invaluable for navigating challenges.

Stay patient and persistent. Credit improvement takes time, but with dedication, you’ll see the fruits of your efforts blossom over time.

Conclusion: Is Bidencash Worth It?

As you weigh the options surrounding Bidencash, it’s clear that real users have experienced tangible benefits from this credit-boosting tool. Many have shared their journeys of improving their credit scores and unlocking new financial opportunities. However, like any service, it’s essential to consider both the advantages and potential drawbacks.

Users appreciate the user-friendly interface and straightforward process. Success stories highlight how Bidencash has helped individuals secure loans or better interest rates they previously thought unattainable. Yet, there are some caveats to keep in mind. It may not be a one-size-fits-all solution; results can vary based on individual circumstances.

To maximize your experience with Bidencash, being proactive is key. Stay informed about your credit status and utilize all features offered by the platform fully.

Whether Bidencash.cc is worth it depends on your personal financial situation and goals. With careful consideration and an understanding of how it works, you can make an educated decision about integrating this tool into your path toward improved financial wellness.

Orient Electric Areva Portable Room Heater | 2000W | Two Heating Modes | Advanced Overheat Protection | Horizontal & Vertical Mount | 1-year replacement warranty by Orient | White

₹1,499.00 (as of 24 December, 2024 11:23 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Nova Lint Remover for Clothes Fabric Shaver for Woolen Clothes | 2 Year Warranty

₹348.00 (as of 24 December, 2024 11:25 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Milton Euroline Go Electro 2.0 Stainless Steel Electric Kettle, 1 Piece, 2 Litre, Silver, Power Indicator, 1500 Watts, Auto Cut-off, Detachable 360 Degree Connector, Boiler for Water, Instant Noodles

₹799.00 (as of 24 December, 2024 11:23 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)MOKRUSH Cordless Portable Wireless Pressure Washer Gun 48V 12000mah High Pressure Water Gun for Car Wash Bike Washing Cleaning| Adjustable Nozzle and 5M Hose Pipe (Double_Battery) (Black 1)

₹1,499.00 (as of 24 December, 2024 11:25 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)AGARO Elite Lint Remover With Power Cord for Woollen Sweaters, Blankets, Jackets/Burr Remover Pill Remover from Carpets, Curtains

₹379.00 (as of 24 December, 2024 11:23 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Discover more from The General Post

Subscribe to get the latest posts sent to your email.